washington state long term care tax opt out deadline

Learn more about changes to the program key dates and what employers need to know. The video below will walk you through the opt-out process.

What You Need To Know About The New Washington State Long Term Care Act Coldstream Wealth Management

Workers on non-immigrant visas can opt out.

. The Washington state House on Wednesday voted 91-6 to delay the implementation of the mandatory long-term care payroll tax by 18 months. Long term care insurance washington state tax opt out Tuesday March 1 2022 Edit The Washington State Long Term Care Trust Act Opt Out Is Now Available Online Parker Smith Feek Business Insurance Employee Benefits Surety. They reluctantly allowed a single opt-out choice that expires Nov.

1 to opt-out which has been set up to help pay for nursing care and other support services for people who cant care for themselves. The new tax is for a mandatory long-term-care program called the WA Cares Fund. The window to apply for an exemption occurs between October 1 st 2021 and December 31 st 2022.

Veterans with 70 disability can opt out. Near-retirees earn partial benefits for each year they work. Washington state long term care tax opt out requirements Sunday April 3 2022 A timeframe does exist to apply for an exemption however.

Its Getting Late to Opt Out of Washingtons Long-Term Care Program. Its Getting Late to Opt Out of Washingtons Long-Term Care Program A first-of-its-kind paycheck deduction has led many to seek private insurance. Military spouses can opt out.

OLYMPIA Its almost time for Washington residents to decide between a state long-term health care benefit or a private one. Long-term care policies must have been purchased by November 1 2021 to qualify for the exemption. The deadline to opt out of the Washington State mandatory LTC tax is November 1 2021.

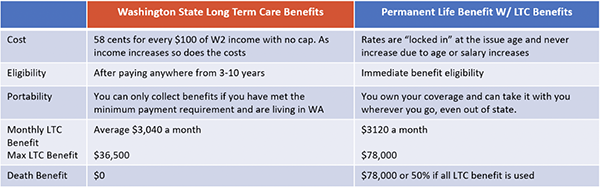

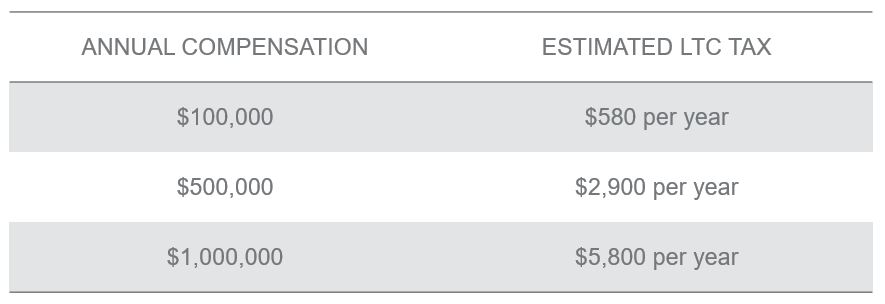

The regressive tax is 58 cents per 100 earned with no income limit. 1 2021 must still apply by Dec. Benefits will be available for eligible Washingtonians starting in July 2026.

Workers who wish to apply for an exemption because they hold a long-term care insurance plan purchased by Nov. Workers in Washington only have until Nov. Beginning in 2022 Washington workers will see a payroll tax for long-term care part of a statewide benefit that will be available to residents beginning in 2025.

Washingtonians like Heidi have a single chance to opt-out by November 1 of this year if they have a qualified long-term care policy in force by the deadline. As a Washington employer you are required to report your employees wages and hours and pay premiums every quarterunless you had no payroll expenses during that quarter. Workers have until this November to opt out.

You have one opportunity to opt out of the program by having a long-term care insurance policy in place by November 1 st 2021. 1 2021 to opt out of a 058 tax as part of the newly passed Long-Term Care Trust Act. You must also currently reside in the State of Washington when you need care.

Washington was prepared to roll out this program at the beginning of the year but the new bills have delayed the timeline by 18 months. Beginning in 2022 Washington workers will see a payroll tax for. Your choice is permanent If you apply and are approved for an exemption youll be permanently disqualified from WA Cares.

Keep in mind that once you opt. October 31 2021 at 924 pm PDT. One man I spoke with recently.

In 2019 Democrats in Olympia passed a hefty new payroll tax that will hit paychecks starting in January. Monday is the deadline to have your private long-term care insurance plan in place in order to opt out of. If you meet the opt-out criteria and purchased your LTC policy prior to Nov 1 2021 you have until December 31 2022 to opt-out of the tax.

Under current law Washington residents have one opportunity to opt-out of this tax by having a long-term care insurance LTC policy in place by November 1st 2021. But the best financial route for some locals may be to do nothing at all. W-2 employees in Washington have until Nov.

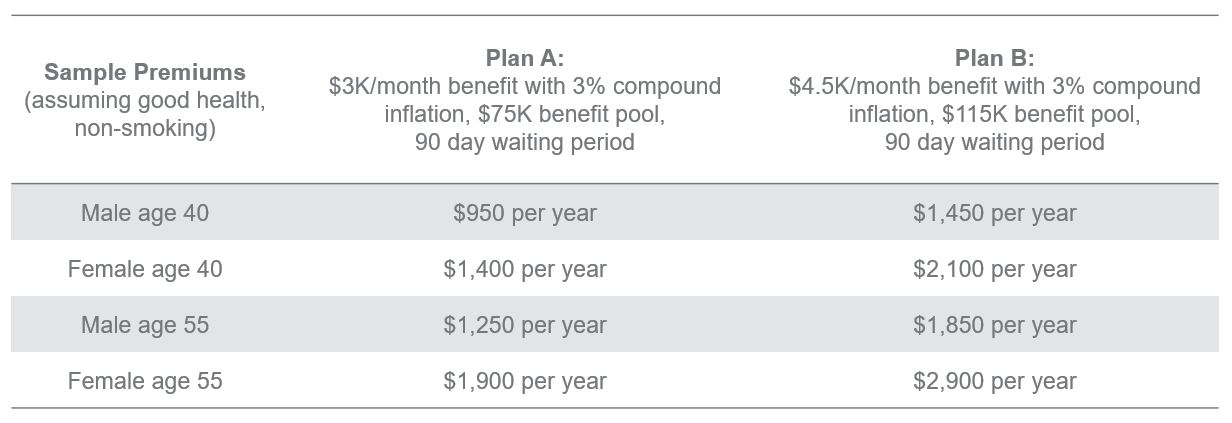

The new 058 state payroll tax paid entirely by employees is set to begin in January and is equivalent to 580 per year for someone who makes 100000. Beginning in 2022 Washington workers will see a payroll tax for long-term care part of a statewide benefit that will be available to residents beginning in 2025. WA Cares is designed to be a universal program like Medicare but the law allows workers to opt out if they already have private long-term-care insurance before Nov.

Purchase a personal long term care policy today. Now workers in Washington wont see this deduction from their paychecks until July 2023 at the earliest. By Benjamin Cassidy August 17 2021.

The Window to Opt-Out. 1 and apply for an exemption. With opt-out deadline looming Washingtons long-term care benefit and tax draws praise criticism.

Workers who live out of state can opt out.

Washington State Long Term Care Tax Here S How To Opt Out

Making Sense Of Washington S New Long Term Care Law Parker Smith Feek Business Insurance Employee Benefits Surety

Washington S First In The Nation Long Term Care Program Starts In January With Opt Out Deadline Soon Local News Spokane The Pacific Northwest Inlander News Politics Music Calendar Events In Spokane Coeur D Alene

Webinar Explores New State Long Term Care Insurance Association Of Washington Business

Want To Opt Out Of Washington S New Long Term Care Tax Good Luck Getting A Private Policy In Time Northwest Public Broadcasting

-1.jpg?width=565&name=WA%20Trust%20Act%20Tax%20(based%20on%20salary)-1.jpg)

Washington State Is Creating The First Public Ltc Plan Who S Next

Wa Cares Exemption How To Opt Out Of The Tax Brighton Jones

Washington State Long Term Care Trust Act 0 58 Payroll Tax 36 500 Lifetime Maximum Benefit Page 8 Bogleheads Org

In The First Month Washington Averaged Nearly 10 000 Exemption Applications Per Day To The State S New Long Term Care Tax

Long Term Care Enrollment Deadline Extended To Oct 14 Afscme Council 28 Wfse

Loophole Around The Mandatory Ltc In Washington State Achieve Alpha

New Wa Long Term Care Tax Delayed So Legislature Can Fix It Crosscut

Can You Opt Out Of State S New Long Term Care Act And Tax Should You

What You Need To Know About The New Washington State Long Term Care Act Coldstream Wealth Management

Updated Get Ready For Washington State S New Long Term Care Program Sequoia

Washington State Trust Act Should You Opt Out Buddyins

Washington Long Term Care Tax How To Opt Out To Avoid Taxes

Potential Delay Of New Long Term Care Payroll Tax Considered