b&o tax rate

The Manufacturing BO tax rate is 0484 percent 000484 of your gross receipts. Washingtons BO is an excise tax measured by the value of products gross proceeds of sales or gross income of a business with over 30 different classifications and associated tax rates.

The BO Tax imposed shall not exceed more that the.

. You must file your Seattle taxes separately from your state taxes. B O Tax. V voter approved increase above statutory limit e rate higher.

Since a composite return is a combination of various individuals various rates cannot be assessed. Current Tax Rate for 2022 Revenue and Before Retailing 00050. There is levied upon and shall be collected from any person engaging or continuing in any business or other activities set forth in Section 78703 annual privilege taxes in an amount.

Greater than 50000 per year. The tax amount is based on the value of the manufactured products or by-products. The December 2020 total local sales tax rate was also 6625.

This is the total of state county and city sales tax rates. What is the sales tax rate in Piscataway New Jersey. Contact the city directly for specific information or other business licenses or taxes that may apply.

The minimum combined 2022 sales tax rate for Ridgefield Park New Jersey is. See all City business tax rules. The Bank of England will next week consider how much to raise interest rates without having received any guidance from the.

When paying the B O tax to the Department of Revenue you declare your income in different categories. Legislation adopted in the 2003 session required the 45 cities with local BO taxes to adopt a city BO tax model ordinance. The minimum combined 2022 sales tax rate for Piscataway New Jersey is.

The New Jersey sales tax rate is currently. The current total local sales tax rate in South Plainfield NJ is 6625. This is the total of state county and city sales tax rates.

1355 are as follows. 2 days agoFirst published on Wed 26 Oct 2022 1005 EDT. 50000 or less per year.

Therefore the composite return Form NJ-1080C uses the highest tax. 0002 times the net taxable revenue. To learn more about the state BO tax visit the Washington State Department of Revenue.

The model was updated in 2007 2012 and 2019EHB. BO Tax Rate Change Beginning Jan. Have a local BO tax.

The rates established by Ordinance No. Most Washington businesses fall under the 15 gross receipts tax rate.

Business Taxes In Washington Remain Well Above U S Average Opportunity Washington

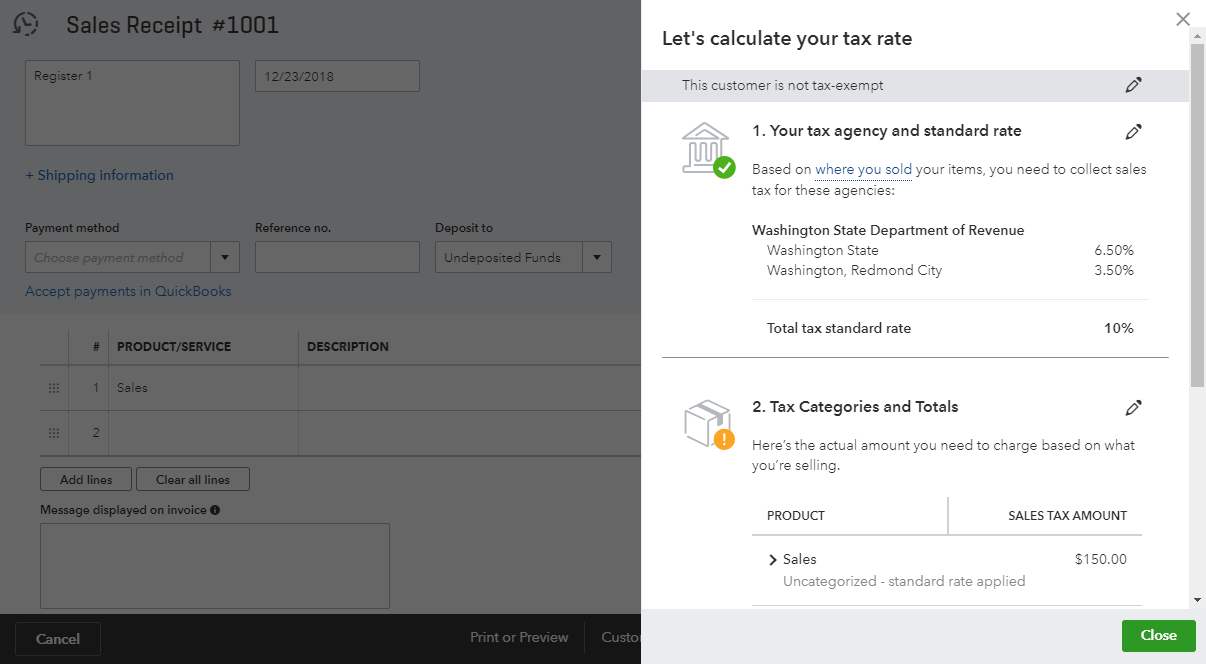

How To Record Washington State Sales Tax In Quickbooks Online Evergreen Small Business

Business Occupation Tax Clarksburg Wv

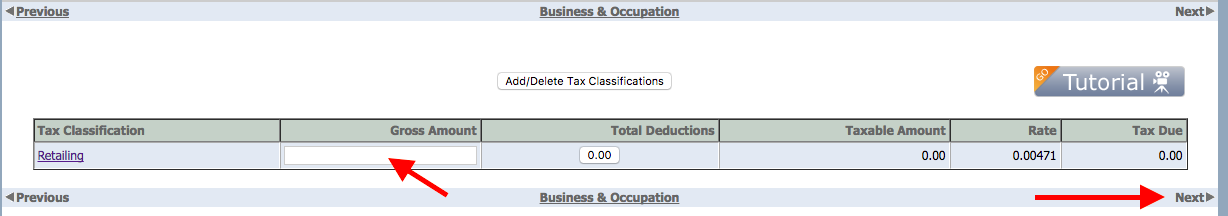

Taxjar Autofilers How To File Washington Business And Occupation Tax Taxjar

Am I Taxed Too Much Understanding The Impacts Of Fiscal Policy Washington State Wire

Analyzing The New Oregon Corporate Activity Tax

Business Occupation Tax Bainbridge Island Wa Official Website

B Amp O Tax Guide City Of Bellevue

B Amp O Tax Return City Of Bellevue

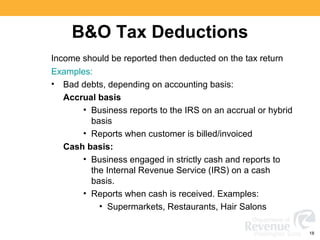

Washington State Sales Use And B O Tax Workshop

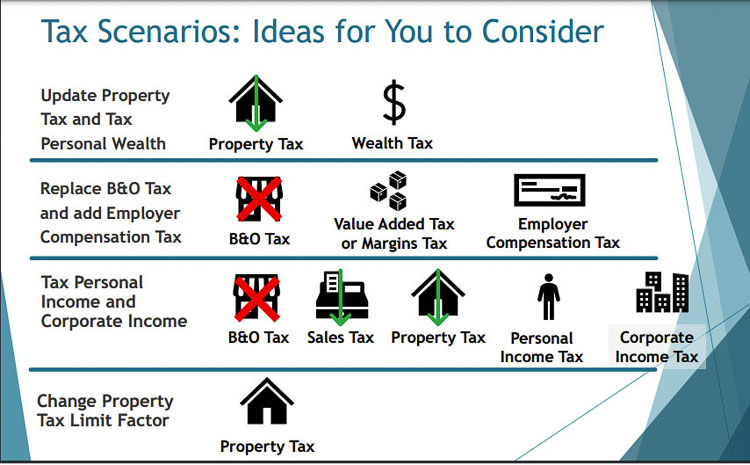

State Tax Structure Workgroup Seeks Input For Possible Changes To Washington Tax System Clarkcountytoday Com

Wa Tax Change Impacts Out Of State Businesses

B O Tax Burlington Wa Official Website

Treasury Business Occupation Tax Bluefield West Virginia

The Washington B O Tax Nexus Traps For The Unwary Taxpayer Deloitte Us

Auburn Studies First Draft Of Proposed B O Tax Auburn Reporter

Business Occupation Tax Bainbridge Island Wa Official Website

Business And Occupation Tax City Of Renton

State Tax Structure Workgroup Seeks Input For Possible Changes To Washington Tax System Clarkcountytoday Com